Signage is displayed in the window of a Comcast Corp. Xfinity store in King Of Prussia, Pennsylvania.

Charles Mostoller | Bloomberg | Getty Images

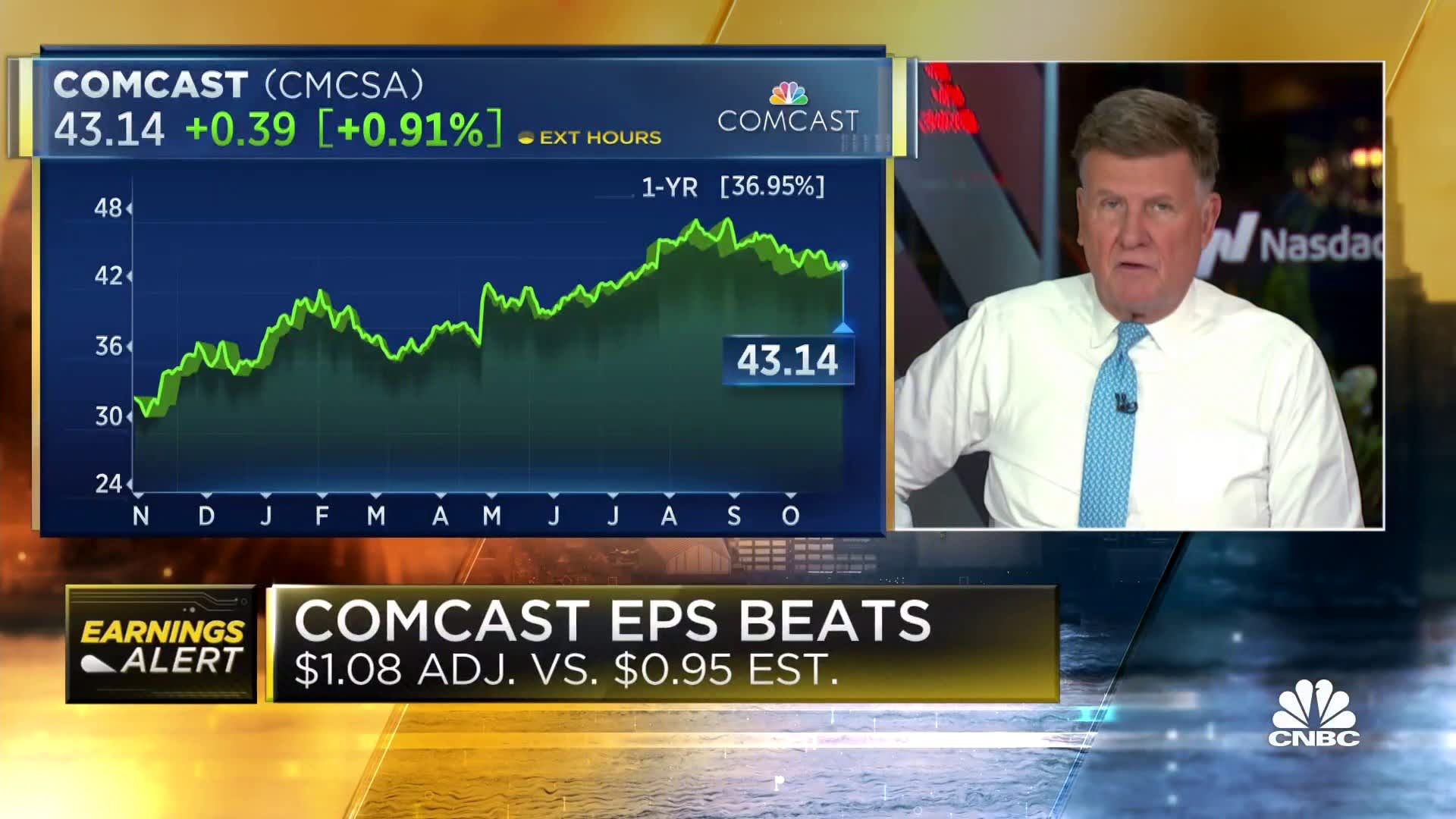

Comcast has tried to move investors away from focusing on residential broadband net additions. The market reaction to the company’s third quarter results suggests that isn’t working.

Comcast shares fell more than 8% Thursday after the company reported a loss of 18,000 residential broadband customers in the third quarter and warned losses will be larger in the fourth quarter.

Rising interest rates have slowed the buying and selling of houses, which has led to a decline in new home internet connections. Mortgage demand is at its lowest point in nearly 30 years. The 30-year fixed mortgage rate hit 8% last week for the first time since 2000. Additionally, new competition for home broadband from wireless providers such as T-Mobile and Verizon had added to Comcast’s lack of residential growth.

Comcast’s lack of broadband growth started last year, when the largest U.S. internet provider reported no additions in the second quarter of 2022 for the first time in the company’s history. Since then, Comcast has reported net broadband losses in three of the last five quarters.

Comcast executives have pushed investors to focus on broadband’s rising average revenue per user (ARPU) growth, driven by price increases and upselling packages, rather than net additions. Comcast’s residential broadband ARPU rose 3.9% in the quarter.

“As we continue to manage this balance, we expect ARPU growth to remain strong and our primary driver of broadband revenue growth with somewhat higher subscribers losses expected the fourth quarter

compared to the 18,000 loss we just reported in the third quarter,” Comcast Chief Financial Officer Jason Armstrong said during the company’s earnings conference call Thursday.

Shrugs for NBCUniversal

Comcast also owns NBCUniversal, a company ostensibly worth tens of billions. Theme park revenue rose more than 17% in the quarter, and streaming service Peacock added 4 million subscribers in the quarter, stemming losses from a year ago.

But investors shrugged at those results and focused on the company’s guidance that broadband growth won’t return next quarter.

Comcast on Thursday reiterated it plans to return to broadband growth eventually, while not offering a specific timeline. While a rough housing market is a clear headwind on broadband additions, T-Mobile added 557,000 new high-speed broadband customers in its third quarter. Verizon reported net additions of 434,000. That speaks to Comcast’s decision not to engage in a price war with wireless competitors.

“It’s a pretty competitive environment,” Comcast cable President Dave Watson said on Thursday’s earnings call. “We’ve seen the expansion of both fiber and fixed wireless’s footprint. Part of our game plan is we’re going to continue invest in a better network and compete aggressively but we’re going to maintain financial discipline. That means making certain decisions when it comes to balancing rate and volume.”

Comcast added 294,000 wireless subscribers in the quarter, as it fights back against wireless company competition by eating into some of their subscribers. Still, residential broadband has a much higher profit margin for Comcast and derives far more revenue for the company.

Comcast reported broadband revenue of $6.4 billion in the quarter from 32.3 million subscribers, or an average of about $200 in revenue in the quarter per subscriber. Comcast reported $917 million in revenue from its 6.3 million wireless customers — $145 in revenue per subscriber for the quarter.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.

WATCH: Comcast reports third-quarter earnings.